Need Help Navigating Your Benefits?

Health Advocate can help you find the right doctors, schedule appointments, assist in the transfer of medical records, work with insurance companies, resolve benefits issues, get help with eldercare, answer your questions, and help you make informed decisions.

During your first call, you will be assigned a Personal Health Advocate who will begin helping you right away. Personal Health Advocates are typically registered nurses, supported by medical directors and benefits and claims specialists. They’ll help cut through the red tape and assist with complex conditions, find specialists, address eldercare issues, clarify insurance coverage, work on claim denials, help negotiate fees for non-covered services and get to the heart of your issue.

Get Started Today!

866.695.8622

ALEX – Decision Making Tool

Time to choose your benefits – Let ALEX help!

ALEX is the host of unique, online experience that will help you understand and make decisions about your benefits. “Talking” with him is easy. He’ll ask some basic questions about your personal situation (your answers remain anonymous, of course), crunch some numbers, and explain your available benefit options – all while making you laugh!

Eligibility

All employees who work a minimum of twenty (20) hours per week are eligible for coverage on the 1st day of the month following date of hire.

Summary of Benefits and Coverage (SBC’s)

Employee Bi-Weekly Contributions

| Co-Pay Plan | HSA Buy-Up Plan | HSA Base Plan | ||

| EE Only | $93.79 | $70.79 | $22.39 | |

| EE + Child(ren) | $215.34 | $171.64 | $80.33 | |

| EE + Spouse | $228.98 | $182.97 | $86.85 | |

| EE + Family | $350.53 | $283.83 | $144.45 |

Eligibility

All employees who work a minimum of twenty (20) hours per week are eligible for coverage on the 1st day of the month following date of hire.

Prescription Benefit Coverage

Mail Order Prescription Program

Phone: 866-893-6337

Web ID: MASCOMA

Visit Canarx Website to learn more!

CANARX: Mail Order Prescription Program

CANARX is a voluntary international mail order prescription program that is available to employees and their dependents who are enrolled in the Adirondack Health MVP plan.

Brand name medications, in the original factory-sealed manufacturers packaging, are delivered DIRECT TO YOUR DOOR from certified pharmacies in Canada, UK and Australia. YOU PAY NOTHING thanks to the savings CANARX brings to your plan.

Why Join?

- Voluntary mail-order program

- FREE brand-name maintenance medications

- Quick and easy enrollment process

- Shipped directly to the member’s door (no shipping and handling charges to you)

- $0 Copay (no costs to members)

- Easy and convenient refills

- 4 week delivery time

- Join anytime (not just during open enrollment)

- No additional costs

Getting started is easy!

- Check to see if a medication is offered. Call 866-893-6337 and speak with a CANARX representative or view the complete formulary and print enrollment material at www.canarx.com, Web ID: ADIRONDACK.

- Ask your doctor for a prescription for a 3 month supply, with 3 refills.

- Submit documentation (completed enrollment form, prescription and a copy of your photo ID).

- Sit back and relax….medication will be mailed direct to your home within 4 weeks.

Enroll Today in 3 Easy Steps!

1. Check for medication – Check to see if your medication is offered. Full listing can be found on the website or call CANARX at 866-893-6337.

2. Enroll – Enroll online or complete an enrollment form. Submit the printed enrollment form and copy of Photo ID via canarxdocs.com, by mail or fax.

3. Submit Prescription – request a prescription for a 3 month supply, with 3 refills. Mail original prescription to CANARX or have the physician’s office fax it directly to CANARX at 866-715-6337.

Helpful Resources

RxBenefits: Retail Pharmacy Program

![]()

Customer Service: 800-334-8134

Email: customercare@rxbenefits.com

website: www.rxbenefits.com

Register as a Member to:

- Access real-time prior authorization status, including explanations of determinations, and view up to 18 months of previous prior authorization activity

- View up to 18 months of pharmacy claims (including claims for eligible dependents)

- View, download and email copies of ID cards

- Access your account across multiple devices, including computers, tablets, and cell phones

- Ability to chat with live RxB agents for questions

- Seamlessly navigate to the PBM portal without the need to sign in again for questions such as specific drug coverage check against the formulary and to find a pharmacy nearby

Forms and Plan Documents

Discount Programs for Weight Loss

Forms & Resources

Eligibility

|

Health Savings Account (HSA)

| A Health Savings Account, or HSA, is a custodial account established toreceive tax-favored contributions on behalf of eligible active employees enrolled only in a qualified high deductible plan to pay for IRS qualified medical expenses. |

Contributions

|

Eligibility

All employees who work a minimum of twenty (20) hours per week are eligible for coverage on the 1st day of the month following date of hire.

Flexible Spending Account (FSA)

Annual Max & Utilization:

The annual maximum amount you may contribute to this FSA is $3,300 per calendar year. This program allows employees to use pre-tax dollars for certain IRS-approved expenses. You may roll over up to $660 into the next plan year. Any remaining unused funds will be forfeited.

Some examples include:

- Hearing services, including hearing aids and batteries

- Vision services, including contact lenses, contact lens solution and eyeglasses

- Dental services and orthodontia

- Medical and Rx deductibles

- Reimbursable through the FSA unless you have a prescription from your physician.

An FSA is a great way to set aside money to cover the employee portion of the deductible on the medical plan. For more information on Flexible Spending Accounts, visit https://www.healthcare.gov/have-job-based-coverage/flexible-spending-accounts/

Dependent Care FSA

If your salary is less than $135,000, as of January 1, 2025, Mascoma will match contributions into your Dependent Care Reimbursement Account for a total of $500.00 per year ($20.83 per pay).

Match will be contributed into your Dependent Care Account each pay. You may use the match for any eligible daycare expenses.

If your salary exceeds $135,000 during the year, the match will discontinue.

Eligible Day Care Expenses:

- Childcare/Adult Care by a licensed childcare facility for children under age 13 who qualify as dependents on your federal income tax return

- Childcare/Adult Care for children or adult of any age who are physically or mentally unable to care for themselves and who qualify as dependents

Ineligible Day Care Expenses:

-

Child support payments

-

Food, clothing and entertainment

-

Educational supplies and activity fees

-

Cleaning and cooking services not provided by the day care provider

- Overnight camp

To qualify for a Dependent Care Account, either both spouses need to be employed or full-time students.

Forms and Plan Documents

The Richards Group has entered into a partnership with Health-E Commerce, also known as the FSA/HSA Store. This gives you access to hundreds of products that have been pre-vetted & approved for use with your Flexible Spending or Health Savings Accounts.

Did you know you could use your FSA/HSA to save money on everyday health essentials like baby health items, health trackers, pain relief products and more?

Here are just a few benefits of using the FSA/HSA Store:

- No Receipts Needed

- 2,500+ FSA Eligible Products

- 100% Eligibility Guaranteed

- Skip the claims process when you use your FSA/HSA card

This partnership also allows access to their Caring Mill products. Caring Mill is a line of premium healthcare products that support a healthy lifestyle and on average is priced 30% less than branded equivalent products.

With every Caring Mill purchase, a donation is made to Children’s Health Fund, providing necessary treatments to thousands of children in need, throughout the United States.

Curious what your FSA/HSA dollars can cover? Simply enter the product you are looking for in the eligibility list below.

To access the FSA Store please visit: https://fsastore.com

To access the HSA Store please visit: https://hsastore.com

Additional Information

Eligibility

All employees who work a minimum of twenty (20) hours per week are eligible for coverage on the 1st day of the month following date of hire.

Bi-Weekly Employee Contributions

| Base Plan | ||||

|---|---|---|---|---|

| Hours Worked: | 40+ Hours | 30-39 hours | 20-29 hours | |

| EE Only | $0.00 | $8.10 | $11.76 | |

| EE + Child | $18.13 | $26.23 | $29.89 | |

| EE + Spouse | $18.13 | $26.23 | $29.89 | |

| EE + Children | $50.18 | $58.27 | $61.93 | |

| EE + Family | $50.18 | $58.27 | $61.93 | |

| Enhanced Plan | ||||

|---|---|---|---|---|

| Hours Worked: | 40+ Hours | 30-39 hours | 20-29 hours | |

| EE Only | $9.54 | $17.63 | $21.30 | |

| EE + Child | $36.63 | $44.72 | $48.38 | |

| EE + Spouse | $36.63 | $44.72 | $48.38 | |

| EE + Children | $81.60 | $89.70 | $93.36 | |

| EE + Family | $81.60 | $89.70 | $93.36 | |

Eligibility

All employees who work a minimum of twenty (20) hours per week are eligible for coverage on the 1st day of the month following date of hire.

Vision

Bi-weekly Employee Contributions

| Base Plan | Enhanced Plan | ||

| EE Only | $2.69 | $6.30 | |

| EE + Child(ren) | $4.90 | $10.68 | |

| EE + Spouse | $5.03 | $10.92 | |

| EE + Family | $8.71 | $18.22 |

Mascoma Bank GROUP NUMBER: 30086238

Member Extras

Eligibility

All employees who work a minimum of twenty (20) hours per week are eligible for coverage on the 1st day of the month following date of hire.

Employer Paid Life/AD&D

Basic Life and AD&D Insurance(100% paid by Mascoma Bank)

- 2 times annual salary to maximum of $750,000

- AD&D (accidental death & dismemberment) mirrors the benefit value if death results from an accident

- Benefits reduced to 65% upon reaching age 65

Employer Paid Dependent Basic Life

- Life benefit amount for dependents

- Flat benefit amount of $10,000 for Spouse

- Flat benefit amount of $2,500 per Child

Supplemental Life Insurance

Voluntary Life Insurance

- Choice of coverage in $10,000 increments to max of 5 x annual salary or $500,000 – whichever is less

- Benefits reduced to 65% upon reaching age 70

- Employees are required to give satisfactory evidence of insurability for supplemental life amounts over $100,000; after initial eligibility all benefit amounts require evidence of insurability

Dependent Life Insurance

- Choice of coverage for a spouse in increments of $5,000 to a maximum of $500,000.

- Spouse will be required to give satisfactory evidence of insurability for supplemental life amounts above $25,000 upon initial eligibility; after initial eligibility all benefit amounts are subject to evidence of insurability.

- Dependent children under age 26, in increments of $2,000 to a maximum of $10,000

Contributions

Supplemental Life Insurance is 100% employee paid. Rates are based on age and benefit amount.

Introducing BriteHR!

Symetra’s Helpful Decision Making Tool

Start Learning

Forms and Plan Documents

Eligibility

All employees who work a minimum of twenty (20) hours per week are eligible for coverage on the 1st day of the month following date of hire.

Disability Insurance

Short-Term Disability Insurance – Administered by Mascoma Bank

- Benefit begins on the first day of a disability due to an accident and 7th day of a disability due to an illness

- Benefit is 100% of current base rate of pay to a maximum of $3,000/week

- The maximum benefit period is 13 weeks per eligible disability

Long-Term Disability Insurance

- Benefit is 60% of basic monthly pay up to $15,000 maximum per month

- Payment of benefits begin after 90 days from the start of a qualified disability

- Benefits are payable until you reach the Social Security Normal Retirement Age

Contributions

Mascoma contributes 100% of premiums for disability benefits.

Introducing BriteHR!

Symetra’s Helpful Decision Making Tool

Start Learning

Forms and Plan Documents

Eligibility

All employees who work a minimum of twenty (20) hours per week are eligible for coverage on the 1st day of the month following date of hire.

Accident & Critical Illness

Accident Insurance

-

Available to help covered employees meet expenses (ie. out-of-pocket) that can follow an accidental injury

- Plan choices are available for employees, spouses and children

- Your cost depends on which coverage option you choose

- Reimburses up to $50 annually for a covered health screening for you and your spouse

- Benefit reduces to 50% at age 65 and an additional 25% at age 70

Critical Illness Insurance

- Pays lump sum benefit between $10,000 to $30,000, in increments of $10,000 for employees diagnosed with a critical illness.

- Pays lump sum benefit between $5,000 to $15,000, in increments of $5,000 for employee’s children diagnosed with a critical illness.

Hospital Indemnity

- Provides a daily fixed indemnity benefit for eligible hospital confinements.

- Employees can use the benefit as they choose – for instance, to help offset copays, coinsurance or deductibles that may be tied to a hospitalization or lost time from work.

- Hospital Admission

- $1,000 for 1st day of confinement

- $100 daily on day 2+

- Intensive Care Unit

- $1,000 for 1st day of confinement

- $200 daily on day 2+

Contributions

Employees contribute 100% of the premium. Rates are based on age.

Introducing BriteHR!

Symetra’s Helpful Decision Making Tool

Start Learning

Forms and Plan Documents

Employee and Family Assistance Program through Invest EAP

Invest Employee and Household Assistance Program (EAP) is a free, confidential, and independent program that supports the health, safety and well-being of you and your household. When you’re ready to talk, EAP is here for you. Employees and household members receive 5 virtual visits per issue, per year.

How it Works

EAP is easy to access. Contact InvestEAP and you will be matched with a local professional counselor. You’ll receive FREE confidential support, guidance on a plan of action, and helpful resources. All services are currently provided by phone or video. This benefit includes everyone in your household.

Contact Us

InvestEAP

#1-866-660-9533 (24/7, free)

www.investeap.org

Password: Mascoma

Forms and Plan Documents

Student Loan Paydown Plan

Full-time employees and regular part-time employees may be eligible to receive $100.00 per month under the Bank’s student loan repayment plan (Gradifi). This plan benefits employees with college student loans. This benefit is available to employees 90 days after date of hire.

See Summary Plan Description of the Student Loan Paydown Program for more information. This benefit ceases on the date employment ends.

Leave Requests

When caring for yourself or a loved one takes you away from work, you may need to file an FLMA claim. Symetra makes it easy for you to file 24 hours a day, 7 days a week. Go to www.symetra.com/MyGO and click “Start My Claim”, or call 1-877-377-6773 from 8am to 8pm EST, Monday-Friday

Paid Parental Leave

Mascoma Bank’s Parental Leave Benefit policy provides continuous paid, job-protected leave to eligible regular full and part-time team members. Employees receive 100% salary continuation for 12 weeks for Primary Caregivers and 4 weeks for Non-Primary Caregivers. New parents eligible for this benefit include birthing mothers, fathers, adoptive parents, and parents via surrogacy.

Eligibility

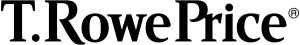

Eligible Team Members are automatically enrolled in, and able to contribute to, the Bank’s 401k Profit Sharing Plan after completing 90 days of employment with the Bank. Approximately 30 days before becoming eligible, each Team Member will receive a Welcome Kit in the mail from T Rowe Price explaining the benefits and options available in the Plan. At that time, Team Members can log into their account to update the beneficiary, change the deferral contribution, and update the investment elections.

New Team Members may, after receiving their first paycheck with the Bank, create a User ID and Password to initiate a 401k rollover from a former employer into the Bank’s 401k Plan. There is no waiting period.

Employee Climate Advantage Loan

Purpose:

To establish an internal loan program to assist in supporting employees in reducing their carbon footprints while aligning with our B-Corp philosophy of being a force for positive change. The loans will be referred to as Employee Climate Advantage Loan.

Eligibility Requirements:

Team Members must be employed by Mascoma Bank for at least 90 days and must be in good standing, employed as a regular full time or part time employee, working at least 18 hours per week and must agree to all the terms and conditions set forth in the loan agreement.

Terms and Conditions:

- Team Members can apply for a loan to purchase; Energy Efficient Appliances; Hybrid Vehicles; Electric Vehicles; eBikes; Electric Motorcycles or Scooters; and Electric Lawnmowers, to aid in the reduction of the employee’s carbon footprint.

- The interest rates for the Employee Climate Advantage Loans will all be 2.99% for the life of the loan except for Solar. Solar loans will receive a 1.00% discount off the posted rate for the life of the loan regardless of installer choice.

- Applications may be obtained from a branch manager or loan officer; however online applications are preferred. Standard underwriting and loan terms apply.

- A copy of the purchase and sales agreement, invoice, or estimate, depending on the loan type. Also proof of purchase will be required.

- Team Members may only have one active Mascoma Climate Advantage Loan out at any given time.

- Repayment of the loan will be made through ACH or AFT only.

- Should the Team Member terminate employment before the loan term has expired, the interest rate will be unchanged.

Other Perks & Benefits at Mascoma Bank

Mascoma Bank takes pride in their employees. There is an extensive list of discounts and perks for employees. More information can be found in Salesforce under Mascoma Community/People Resources/People Resource Groups/Benefits

| Assist America – Emergency Services | Costumania | Pro Optical Discount |

| Student Loan Payment | Dr. Warren Discount | Tickets At Work |

| BJ’s Membership | Embrace Pet Insurance | Tip Top Pottery |

| CCBA Corporate Membership | Irving Oil Discount | Upper Valley Aquatic Center |

| Billings Farms | Meet Up Upper Valley | Verizon Wireless Discount |

| Corporate Perks | Montshire Museum | Resources at Work |

Earned Time Program

Earned Time is a paid time off program that combines all traditional time off benefits into one category. Earned Time replaces separate paid time off policies and includes vacation, personal and sick time. The program works like a bank of days that team members draw upon to cover absences. Hours are credited to an eligible team member’s account at the beginning of every pay period. The accrued time is based on hours worked, employment status and years of service.

Eligibility: All full-time and regular part-time team members are eligible for Earned Time accrual. Part-time less than 18 hours, seasonal and temporary team members are not entitled to any Earned Time.

New hires are eligible on the first of the month following 30 days of employment. Team members will begin to accrue Earned Time hours on the first of the month following the completion of 30 days of employment (there are no accruals during the first thirty (30) days).

Earned time is accrued each pay period based on hours worked, employment status and years of service.

Target Earned Credits Per Month (Prorated during 5th, 10th and 15th anniversary year)

| Full-Time Team Members | Full-Time Officers | |

|---|---|---|

| 1 Year Through 5 Years | 14.67 hrs. – (22 days per yr.) | 18.00 hrs. – (27 days per yr.) |

| 6 Years Through 10 Years | 16.67 hrs. – (25 days per yr.) | 19.33 hrs. – (29 days per yr.) |

| 11 Years Through 15 Years | 18.67 hrs. – (28 days per yr.) | 19.33 hrs. – (29 days per yr.) |

| 16 Years and Up | 21.34 hrs. – (32 days per yr.) | 21.34 hrs. – (32 days per yr.) |

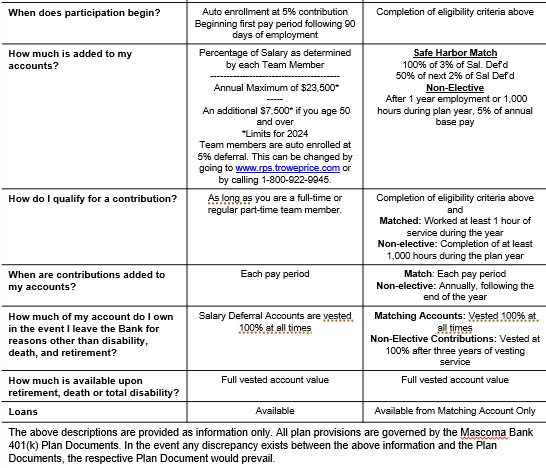

Overview

The Richards Group has partnered with SmartConnect™, an exclusive, no-cost program created specifically to connect Medicare-eligible working adults to the world of Medicare benefits. Whether an employee plans to continue working or is transitioning to retirement, we tailor solutions designed around their needs. Our agents provide an unfiltered view of the entire range of options and prices available to the employee.

Contact Us

For more information or to get started, please click on the following link: https://gps.smartmatch.com/mascomabank

Your Guide To SmartConnect